Efficient management of financial operations plays a crucial role in maintaining the long-term success of any company. It ensures stability, aids in strategic decision-making, enhances competitiveness, and fosters trust among investors and partners. It’s no wonder, then, that outsourcing financial and accounting processes is gaining increasing popularity among companies of various sizes. It’s an excellent solution for all organizations looking to optimize their operations and reduce costs. Below, we present 7 key reasons why considering a transition to outsourcing is worthwhile:

The Growth and Significance of Financial and Accounting Services Outsourcing

The demand for outsourcing services in finance and accounting continues to rise. In 2022, companies allocated as much as $700 billion¹ for these services. It is estimated that by 2030, the average annual growth rate will reach up to 9%². This means that the value of this market could exceed $1 trillion! These statistics are not too surprising when considering that companies are currently facing shortages of staff with specialized knowledge, as well as dynamic technological advancements. Outsourcing financial and accounting services is a beneficial solution for companies of various sizes and profiles that aim to remain innovative. It provides them with access to specialized knowledge, experience, resources, skills, and technological solutions they do not possess.

“Companies are opting for outsourcing financial and accounting processes not only for purely economic reasons anymore. Technological progress somewhat forces them to introduce increasingly newer and more innovative solutions that go beyond their internal capabilities. In a dynamic and digitized business environment, outsourcing thus becomes a strategic tool that helps companies keep pace with changes and achieve a competitive advantage,” comments Joanna Wojciechowska, Sales Support Partner & Recruitment Expert at Business Services Outsourcing, Managed Services, Devire.

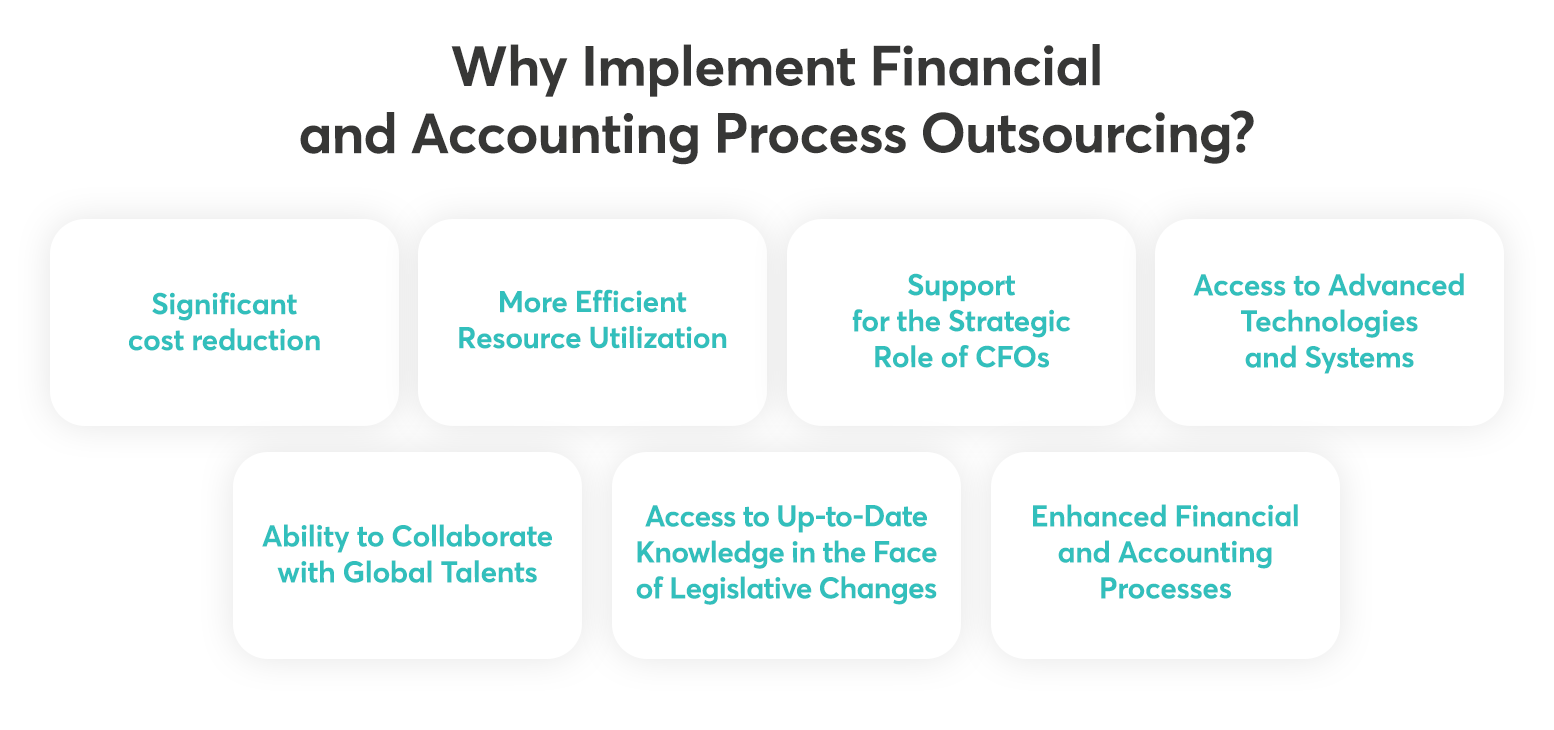

Why Implement Financial and Accounting Process Outsourcing?

In recent years, outsourcing has become a solution that helps companies maintain financial stability. Currently, it drives their development, provides access to advanced technology, and a wide pool of talent. It also allows maintaining flexibility in scaling resources and adapting services to the current needs of the company. What other benefits does it bring? Discover 7 reasons why it’s worth leveraging outsourcing for financial and accounting processes:

1. Significant cost reduction

Outsourcing enables organizations to scale their operations without incurring high costs of maintaining full-time accounting or financial staff. Companies don’t have to cover employee benefits such as taxes on wages, health insurance, vacations, sick days, or retirement plans. Maintaining an internal finance or accounting department also entails many costs associated with training and qualifications enhancement, as well as employee motivation. Additionally, there are expenses related to office space, equipment, licenses, software, and many others.

“All these mentioned expenses are transferred to the outsourcing partner. It’s also worth noting that companies offering financial and accounting process outsourcing typically provide flexible billing models, fully tailored to the needs and budget of each organization. Companies can choose to pay only for specific services or the time dedicated to completing a particular task,” emphasizes Joanna Wojciechowska.

Interested in learning about the benefits of outsourcing office and administrative processes? Read the article.

2. More Efficient Resource Utilization

Maintaining internal finance and accounting departments requires constant supervision and innovation. By partnering with an outsourcing firm, full-time employees can fully focus on their core responsibilities. This significantly increases their productivity and efficiency as they don’t have to spend time on time-consuming and repetitive tasks. This gives them more space to make strategic decisions.

3. Support for the Strategic Role of CFOs

Outsourcing financial and accounting processes also relieves CFOs, allowing them to focus solely on activities related to the company’s development. Their role is no longer limited to internal transactional activities. The CFO’s task now is to manage the financial team in a way that enables the company to grow, maximize revenue, and optimize costs.

“Today, CFOs are proactive leaders who can distinguish themselves with creativity, analytical insight, and the ability to predict trends. By leveraging outsourcing for financial and accounting processes, they can focus on creating and implementing strategic financial plans that allow them to scale and grow the business,” emphasizes Joanna.

4. Access to Advanced Technologies and Systems

Companies may not always be able to keep up with the latest developments in financial and accounting applications. This may be due to factors such as high costs, lack of specialized knowledge, or appropriate experience. Financial and accounting management tools and associated licenses are usually quite expensive. Their cost may be a barrier for small and medium-sized enterprises struggling with budget constraints.

To continue to grow and remain competitive, outsourcing service providers invest in these technologies and monitor all trends in the finance and accounting field. Moreover, they take full responsibility for implementation and training of specialists. They work exclusively with experienced professionals who have the knowledge and skills necessary for implementing and managing modern applications. As a result, companies outsourcing financial and accounting services can reduce costs. They don’t have to invest in infrastructure or hire new specialists.

5. Ability to Collaborate with Global Talents

The number of experienced accountants and finance specialists in the job market is quite limited. Therefore, companies may struggle to find suitable candidates and be forced to raise salaries or offer additional benefits to attract the best specialists.

However, by leveraging outsourcing for financial and accounting processes, organizations gain access to a significantly larger pool of talents with diverse skills. This allows them to benefit from the knowledge and experience of experts in various fields.

“Hiring the best talents is usually a very expensive and time-consuming process. Small and medium-sized enterprises may not have sufficient funds and resources to conduct effective recruitment. Therefore, outsourcing financial and accounting processes relieves internal departments from recruitment responsibilities,” adds Joanna.

6. Access to Up-to-Date Knowledge in the Face of Legislative Changes

In recent years, Poland has witnessed numerous legislative changes. New regulations impose additional obligations on companies and directly impact the work of financial and accounting departments. They require ongoing knowledge updates and adaptation to new procedures. Effective implementation of these changes is necessary to avoid financial penalties, administrative liability, and even punitive measures.

Outsourcing financial and accounting services to an external entity eliminates the risk of errors. Outsourcing firms employ specialists who continuously monitor legislative changes and implement them in a correct and efficient manner.

7. Enhanced Financial and Accounting Processes

Outsourcing firms providing financial and accounting services only hire experienced professionals. Equipped with an advanced set of skills and technology, they can ensure the smooth and effective execution of even the most advanced and complex projects. Thanks to efficient processes and know-how, the outsourcing company can guarantee significantly higher productivity and quality.

By outsourcing processes, companies can eliminate outdated financial and accounting systems and replace them with automated and modern processes. Task automation not only relieves employees from tedious tasks but also significantly reduces the risk of errors.

Why Opt for Outsourcing Financial and Accounting Processes — Summary

Efficient financial operations are the cornerstone of long-term success for any company. Business growth relies on cost optimization and maximizing productivity. Sensible expense management allows organizations to maintain financial liquidity and reinvest profits. Additionally, efficient resource and time utilization translate into increased productivity and competitiveness.

To achieve a balance between optimization and maximization, an increasing number of companies are opting for outsourcing financial and accounting processes. Such solutions come with a host of benefits. Effective financial management enables companies to build stability, make informed decisions, enhance competitiveness, and foster trust among investors and partners.

Some of the risks associated with financial and accounting outsourcing may include loss of control over data and processes, risk of data confidentiality breaches, communication issues between the company and the service provider, failure to meet deadlines by the outsourcing firm, changes in laws and regulations, service quality issues, and hidden costs. Before deciding on outsourcing, companies should carefully assess these risks and manage them appropriately to minimize potential negative impacts.

Of course, the key in this case is selecting the right outsourcing partner who can effectively manage the risks associated with financial and accounting outsourcing and minimize their impact on the company’s operations. It’s worth conducting thorough market research, checking references, and potential partners for their experience, reputation, and ability to provide high-quality services while minimizing risks. By doing so, the company can increase the chances of a successful and beneficial experience with financial and accounting outsourcing.

Yes, every company, regardless of its size or industry, can benefit from financial and accounting outsourcing. Financial and accounting outsourcing involves delegating tasks related to accounting, finance, and bookkeeping to an external company or service provider specializing in these areas.

Choosing the right partner for financial and accounting outsourcing requires thorough analysis and evaluation. Companies should consider the experience, reputation, references, technological resources, and understanding of their industry’s specifics by the potential partner. It is also important to precisely define expectations and requirements, as well as to include clear agreements and clauses regarding confidentiality and data security. Ultimately, it should be a strategic decision that takes into account both short-term and long-term goals of the company.

About the Author

Joanna Wojciechowska – Sales Support Partner & Recruitment Expert, with several years of experience in employee outsourcing and permanent recruitment. She leads and coordinates projects in SSC/BPO/Corporate areas, specializing in financial, sales, administrative, and HR profiles. She develops Managed Services (end-to-end outsourcing) service, collaborating with Polish and international organizations.

Planning to implement outsourcing of financial and accounting processes in your organization? Contact us, and we will help you tailor an optimal solution to meet the needs of your company.

Want to learn more about Managed Services opportunities? Check out the possibilities of Managed Services.

Sources Used in This Article:

Deloitte, Outsourcing and Shared Services 2019-2023 Global, Middle East and UAE industry outlook, accessed: 5.03.2024, Source; Grand View Research, Business Process Outsourcing Market Growth & Trends, accessed: 5.03.2024, Source; Deloitte, 2023 Global Shared Services and Outsourcing Survey Executive Summary, accessed: 5.02.2024, Source; EY, Outsourcing of processes as a way of increasing the efficiency, accessed: 5.03.2024, Source; EY, How the finance function can improve resilience through outsourcing, accessed: 5.03.2024, Source; EY, Why five years of transforming tax and finance functions is paying off, accessed: 5.03.2024, Source.

Devire w Polsce

Devire w Polsce Devire w Niemczech

Devire w Niemczech Devire w Czechach

Devire w Czechach Devire w Portugalii

Devire w Portugalii